Desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. The Double Taxation Agreement entered into force on 8 July 1998 and was amended by a protocol signed on 22 September 2009.

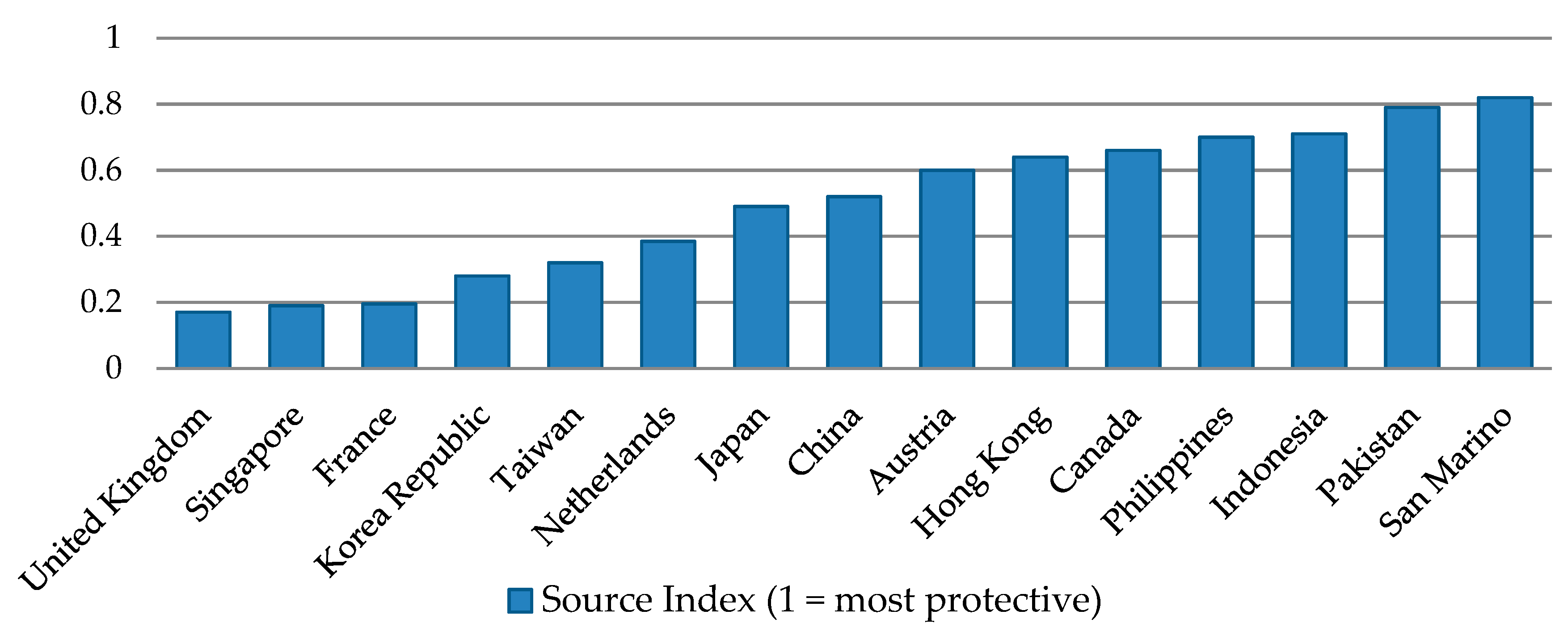

Countries With Double Taxation Treaties With Pakistan Download Table

78 rows 2 Malaysia also has a limited double tax treaty covering air transport operations with Saudi Arabia.

. As the name suggests a double tax agreement is an agreement or a contract regarding double taxation or more correctly the avoidance of double taxation. Australia NIL15 10 3. Such transactions are not tax friendly as international exports and imports are a common source of income for countries.

There is no withholding tax on dividends paid by Malaysia companies. Download a free copy of the sample document Double Taxation Agreements with Malaysia. I the income tax and ii the petroleum income tax hereinafter referred to as Malaysian tax.

Have agreed as follows. Malaysia entered into a double tax agreement DTA with Cambodia CAMMAL DTA which came into force on 1 January 2021. EFFECTIVE DOUBLE TAXATION AGREEMENTS Rates No Country Dividends Interest Royalties Technical Fees 1.

Thus it is an agreement between two sovereign states. Malaysia and Hong Kong concluded a double taxation agreement DTA on 25 April 2012. ARTICLE 2 TAXES COVERED 1.

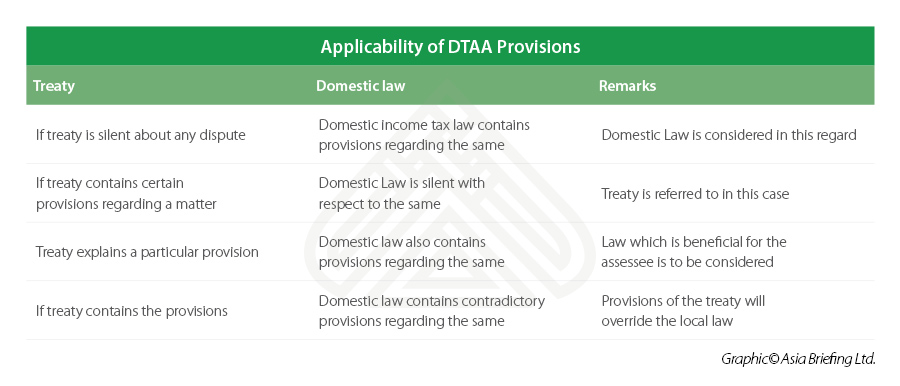

In the case of royalties the withholding tax is set at 10 while for. The double taxation agreements in Malaysia provide protection against fiscal evasion and payment of taxes twice. Ii To claim the DTA rate please attach the Certificate of Tax Residence from the country.

Advocate Client Back. The Government of Ireland and the Government of Malaysia desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows. In order to facilitate the cross-border flow of trade investment financial activities and technical know-how between the two countries the governments of Malaysia and Singapore have signed Avoidance of Double Taxation Agreement DTA.

DOUBLE TAXATION AGREEMENTS WITHHOLDING TAX RATES No. There is no withholding tax on dividends paid by Malaysian companies. ARTICLE 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the Contracting States.

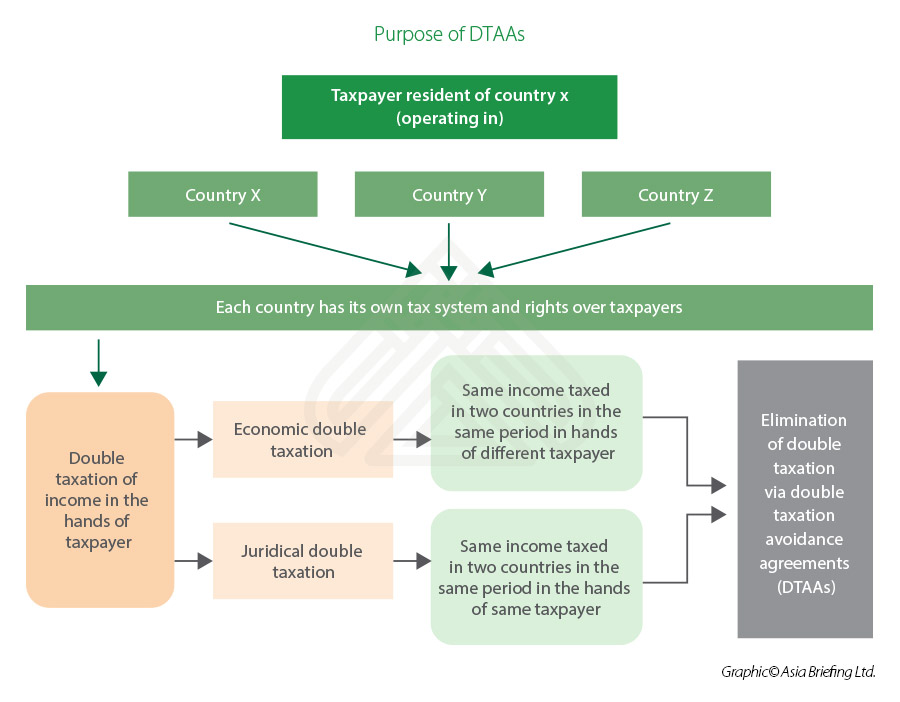

Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the Contracting. Article 1 PERSONS COVERED This Agreement shall apply to persons who are residents of one or both of the Contracting Parties. Double taxation usually occurs when any individual taxpayer of Malaysia engages in an international business transaction within the territory of another country.

Double taxation occurs when a Malaysian taxpayer engages in international or cross. With this DTA Malaysian business owners will need to pay less Cambodian withholding taxes when repatriating their profits to Malaysia in addition to enjoying other taxation benefits. There is no withholding tax on dividends paid by Malaysia companies.

The Government of Malaysia and the Government of the Republic of Singapore desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows. The withholding tax is mentioned by the treaties signed by Malaysia with countries worldwide and it applies to interests and royalties while dividends are exempt. Singapore and Malaysia have endeavored to foster a congenial.

Country Fees for Technical Services 1 Albania NIL 10 10 10 2 Australia NIL 15 10 NIL. However there is nothing in paragraph 18 2 or any other provision of the. Argentina and the United States of America Limited double tax treaty covering air and sea transport operations in international traffic.

Article 1 - PERSONAL SCOPE. A double tax agreement is an agreement between two countries to reduce or eliminate double taxation on the same income. The Government of the Republic of Singapore andthe Government of Malaysia.

Desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income HAVE AGREED AS FOLLOWS. The Singapore-Malaysia Double Tax Treaty. Albania NIL 10 2.

Agreement for Exchange of Information with Respect to Taxes with Gibraltar. As with all double taxation treaties the main objectives of the DTA were to reduce withholding tax rates and avoid double taxation by. Have a read of the commentary below and.

The double taxation agreement signed between Malaysia and Australia became applicable starting with 1981 June 26. Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the. Accordingly where Malaysia pays a government service pension to an Australian resident Malaysia has the right to tax the pension.

From 1981 to 2010 this double tax treaty between Malaysia and Australia has been amended three times over issues concerning exchange of information and business profits. The agreement will enter into force as soon as it has been ratified by Malaysia and Hong Kong respectively. The Government of Malaysia and the Government of the Republic of Indonesia desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows.

Ii To claim the DTA rate please attach the Certificate of Tax Residence from the country of residence. Article 2 TAXES COVERED 1. To tackle this Double Tax Agreement DTA was established.

Paragraph 18 2 of the Agreement provides that government service pensions shall be taxable in the country which pays the pension. Opening a company in Malaysia can be a very profitable. In the Malaysian context a DTA is usually signed by a cabinet minister or sometimes by the prime minister representing his country.

Hereinafter referred to as German tax. 1 January 1999 for taxes. This Agreement shall apply to persons who are residents of one or both of the.

The agreement is effective in Malaysia from. Whereas an Agreement between the Government of the Republic of India and the Government of Gibraltar for the Exchange of. What is a double tax agreement.

Desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income have agreed as follows. The Agreement shall apply also to any identical or substantially similar taxes that are imposed after the date of signature of the Agreement in addition to or in. Article 1 PERSONAL SCOPE This Agreement shall apply to persons who are residents of one or both of the.

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Difference Between Nri And Pio Citizen Finance Personal Finance Different

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

Explained Double Taxation Avoidance Agreement Dtaa Youtube

Can I Deposit Inr In Nre Account In India Nri Saving And Investment Tips Investment Tips Savings And Investment Accounting

Difference Between Wire Transfer Swift And Ach Automated Clearing House Automation Transfer Money Transfer

India S Dtaa Regime A Brief Primer For Foreign Investors

Why And How Nri Should Open Nps National Pension Scheme Account Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

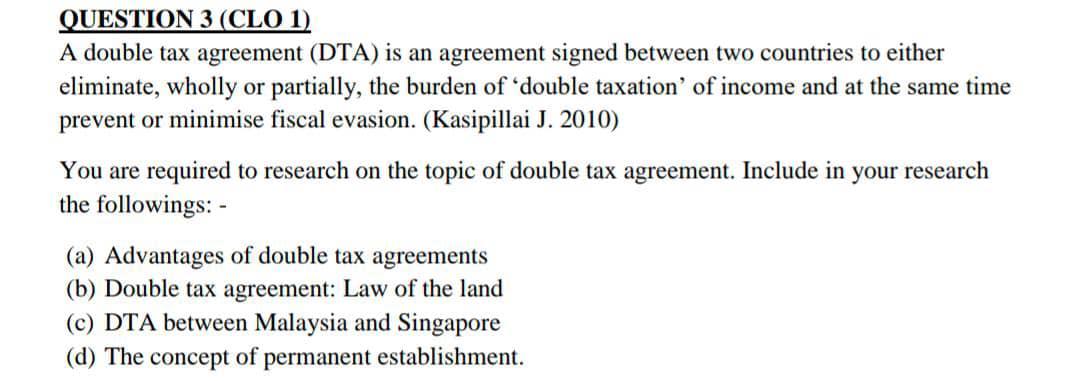

Question 3 Clo 1 A Double Tax Agreement Dta Is An Chegg Com

India S Dtaa Regime A Brief Primer For Foreign Investors

Difference Between Resident And Nri Fixed Deposit India Nri Saving And Investment Tips Savings And Investment Investment Tips Investing

List Of Vietnam S Double Taxation Treaties With Asean Member Countries Download Scientific Diagram

Double Taxation Agreements In Malaysia Acclime Malaysia

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

List Of Vietnam S Double Taxation Treaties With Asean Member Countries Download Scientific Diagram

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Double Taxation Oveview Categories How To Avoid